Global Islamic Banking Assets By Country 2019 Statista. Usually it leads to a headache the discovery that a close friend is actually secretly a raging capitalistsocialist replace as per your political proclivities and the worrying one doubt about ones religion and moral code.

Difference Between Riba Interest Charged In Conventional Banks And Profit Charged By Islamic Banks The Tijara Bulletin

But it is kind of a business agreement between the bank and the.

Do arab banks charge interest. Some people account that withdrawal fee with this Riba. Arab Bank offers its clients a wide range of financing options ranging from corporate lending to more complex specialized financing facilities products and services to cater to corporate andor institutional clients banking needs providing its clients with multiple channels to perform transactions efficiently whether through the branch or electronic channels. They all make money but differently.

Information about interest on fees and charges. Non-Islamic bank The bank says. A traditional bank makes money by lending people money and charging interest on that.

Islamic Vs Conventional Banks In The Gcc Blogs Televisory. An Islamic bank also lends money to people. UAB offers best funds investment opportunity offering time deposits with highly competitive rates and flexible periods tailored to suit your needs and preferences.

Again they take money from other people and pay them interest with lesser rate. Do Arab Banks Charge Interest. The localized expertise available throughout the banks global network ensures that clients requirements are met.

10000 compounded on a Monthly basis over the course of 5 years at a 4 interest rate would be. Arab Bank introduces innovative products and services to cater to corporate clients transaction banking needs. Epf contribution rate 2020 for age above 60 environmental issues in malaysia 2020 epf due date for fy 2019 20 epf deposit last date for april 2020 epf employer and employee contribution rate 2019 epf account 2 withdrawal for house installment environmental issues in malaysia epf contribution percentage 2018 19.

Double your reward points with Arabi Points program when using your credit card for purchases during the period of November 18 th and November 23 rdThis special offer is also available to all credit card online purchases. Why does Islam forbid interest Thats a question we have all asked or been asked at some point in our lives. Entries of interests and commissions 15 USD monthly when being charged charging of other commissions and charges related to account administration.

This applies to any new Balance Transfer fees Money Transfer fees Non-Sterling transaction fees and default charges reaching your account after 28 October 2016. Answer 1 of 25. How do these banks make money.

Some banks accepts this some will say they will transfer it to another account automatically each month. Ive taken loans from Islamic and non-Islamic banks. Visa Gold Visa Shabab Visa Black MasterCard Titanium Visa Platinum Visa FIFA World MasterCard and Visa Signature.

Length of Business Max Loan Max Tenor InterestProfit Rates Processing fee Credit Shield Insurance. Please note this also. Deposits held with Arab Bank PLC.

Do Arab Banks Charge Interest 23 Jun 2021 Posting Komentar Qsr53df52l83vm. Not all products and services mentioned in this website are regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Islamic banking or Islamic finance Arabic.

Yes banks make a lot of money banks from charging borrowers interest but the fees banks change are just as lucrative. Cards eligible for the offer. Any royalty payment that is due Licensor pursuant to this Article 9 that is not paid in full when due shall as to that portion thereof not paid when due bear interest for each day late at the rate of eighteen percent 18 per annum compounded monthly or at the maximum rate allowed by law if said maximum amount is less.

Interest and loans are considered haram in Islamic culture thats why these banks does not charge. 13-15 Moorgate London EC2R 6AD. Lets say you want to buy a car for 10000 over 5 years.

Fund transfer within Arab Bank - Bahrain accounts are free of charges. Some typical financial products that charge fees are checking accounts investment accounts and credit cards. Explainer How Does Islamic Finance Work.

The customer shall be notified of such changes through the means agreed upon between the customer and Arab Bank. Banks usually charge an amount for each ATM withdrawals you do. Time Deposits are available in AED and all major currencies.

And they provide various services and charges money for that also. Another way is talking to the bank not to give you interest. Arab Bank Fees and Charges Sheet as Per PMA Regulation No.

Our solutions offer the flexibility operational efficiency and streamlined processes that make corporate. 42016 that related to Regulation No. Answer 1 of 2.

Gordon Brown is today to make a keynote speech to the Islamic Finance and Trade Conference with the aim of promoting London as a key centre for. In line with your Terms we will now be charging interest on. Islamic Banking Definition.

72014 Description Commissions Details. Europe Arab Bank plc is registered in England and Wales with number 5575857. Interest Charge on Past Due Amounts Free Mortgage Loans Processing Fees 1050 of loan amount min.

Arab Bank has the right from time to time to change the terms and conditions of the products and the interest rate and commissions all in accordance with the applicable laws. Both HSBC Amanah and the IBB charge rent as 695 per cent of the finance taken out with them that is 695 per cent of the share that you dont own not 695 per cent in interest. Based in Michigan the University Bank is one of the many famous banks that provide Islamic banking or non-interest banking services in the United States of America The University Bank even though it is run by an American Board of Directors is in accordance with all the Islamic banking related laws included the Sharia.

مصرفية إسلامية or sharia-compliant finance is banking or financing activity that complies with sharia Islamic law and its practical application through the development of Islamic economicsSome of the modes of Islamic bankingfinance include Mudarabah profit-sharing and loss-bearing Wadiah safekeeping Musharaka joint. BHD 157500 Installment Deferment Charges BHD 10500 Early Repayment Charges. These fees are said to be for maintenances purposes even though maintaining these accounts.

Now coming back to your question. Islamic banks also have same purpose as normal banks to make money for the bank by lending capital.

Islamic Finance The Lowdown On Sharia Compliant Money Islamic Finance The Guardian

What Is Islamic Finance And How Does It Work Global Finance Magazine

Islamic Finance The Lowdown On Sharia Compliant Money Islamic Finance The Guardian

How Different Is Islamic Banking From The Traditional Banking S Silverman Books Blog Writer

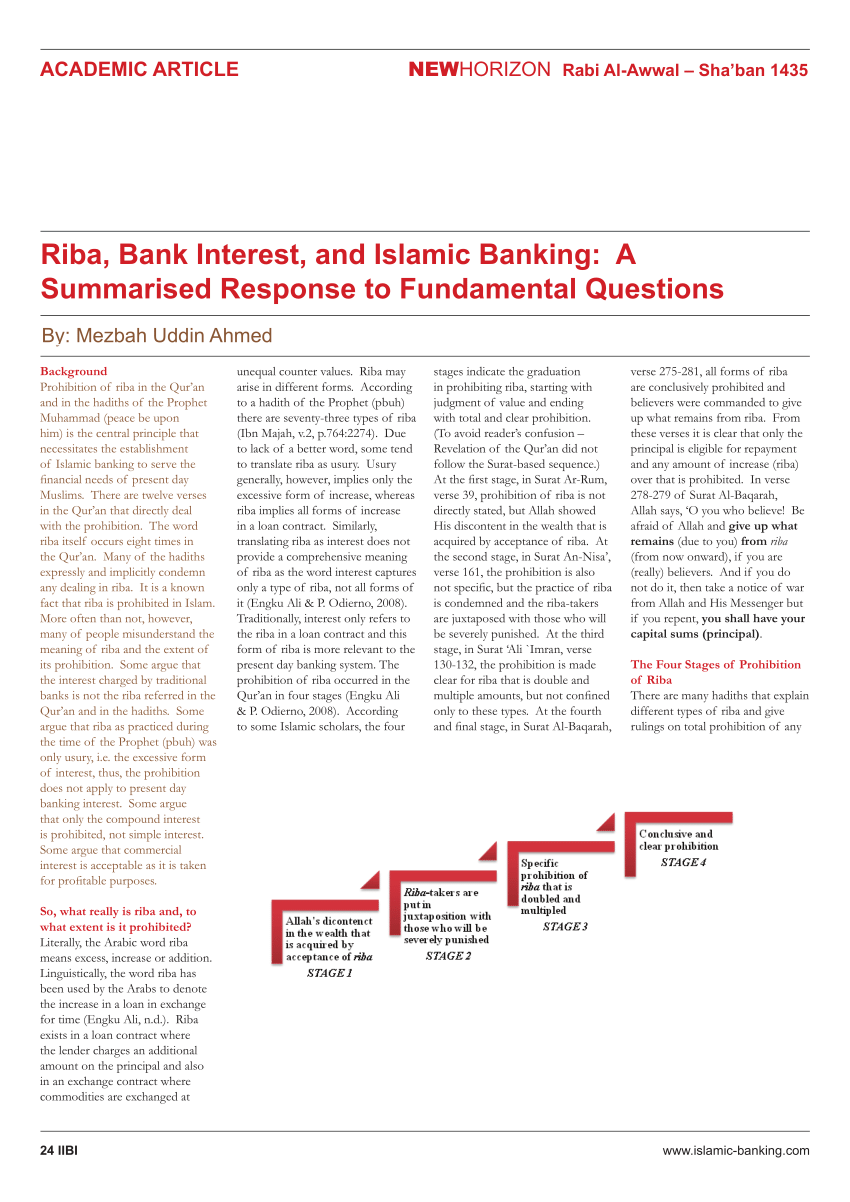

Pdf Riba Bank Interest And Islamic Banking A Summarised Response To Fundamental Questions

Tidak ada komentar:

Posting Komentar